How Long To Depreciate Office Furniture . Web section 179 allows for deductions up to $1 million per year for office furniture and equipment. For example, office furniture belongs to the. See publication 946, how to depreciate property. Web here’s how it works under the normal rules: Say your business bought $2,000 worth of office furniture and started using it may 1. Web in order to calculate the depreciation of your piece of furniture, you need to take the total, not including sales tax, and divide it by its average life. Web based on the calculations, depreciation is $5,000 per year for 10 years. Web according to the rules listed by the internal revenue service (irs), the furniture bought for commercial purposes start. Web real property is 39 year property, office furniture is 7 year property and autos and trucks are 5 year property. The total allowance for equipment purchased is $2,500,00, and. The first three years of macrs depreciation deductions

from www.chegg.com

For example, office furniture belongs to the. The first three years of macrs depreciation deductions Web here’s how it works under the normal rules: Web in order to calculate the depreciation of your piece of furniture, you need to take the total, not including sales tax, and divide it by its average life. Web based on the calculations, depreciation is $5,000 per year for 10 years. Web section 179 allows for deductions up to $1 million per year for office furniture and equipment. Web according to the rules listed by the internal revenue service (irs), the furniture bought for commercial purposes start. See publication 946, how to depreciate property. The total allowance for equipment purchased is $2,500,00, and. Web real property is 39 year property, office furniture is 7 year property and autos and trucks are 5 year property.

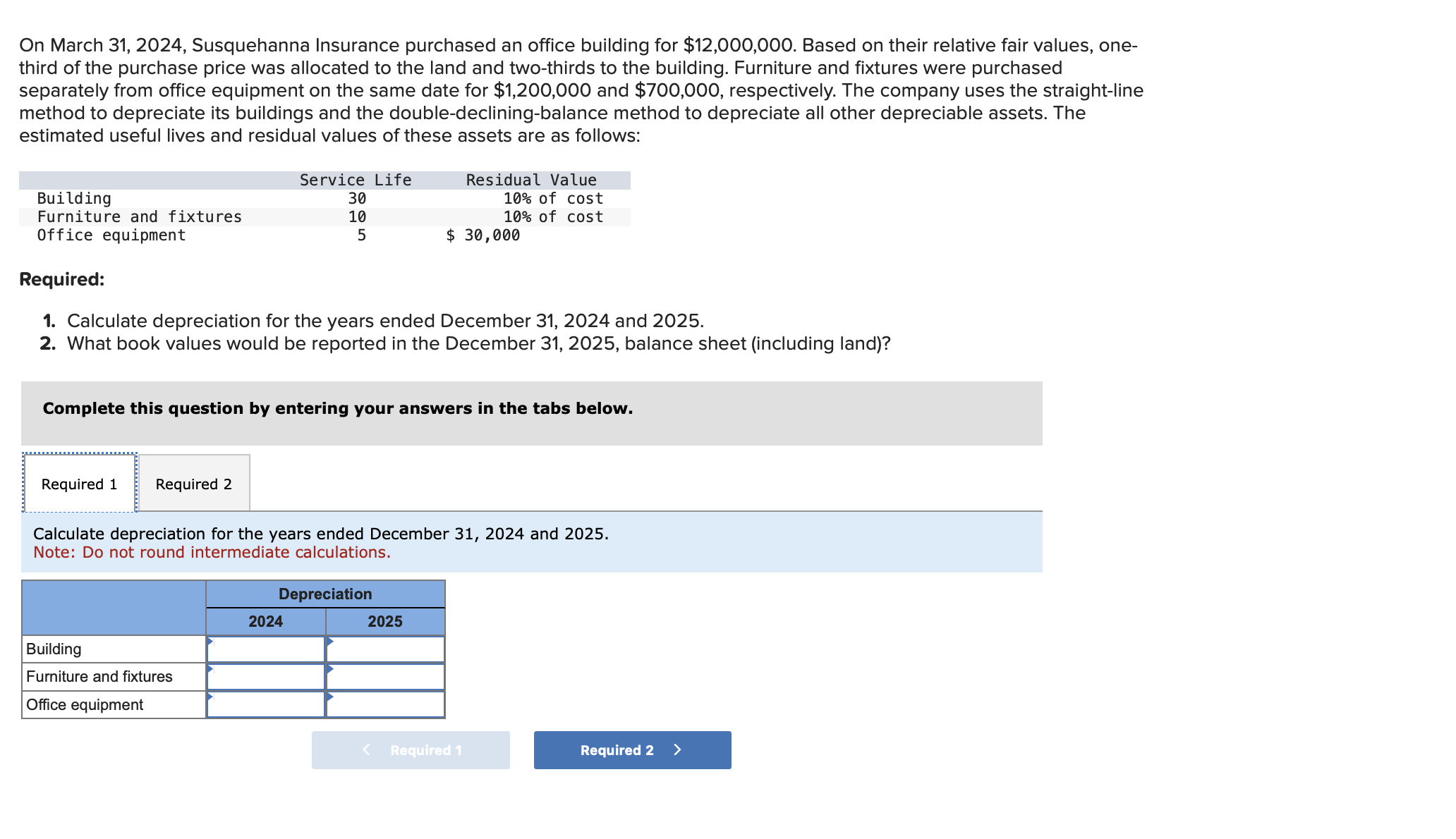

Solved On March 31, 2024, Susquehanna Insurance purchased an

How Long To Depreciate Office Furniture Web here’s how it works under the normal rules: For example, office furniture belongs to the. Web real property is 39 year property, office furniture is 7 year property and autos and trucks are 5 year property. Web here’s how it works under the normal rules: The total allowance for equipment purchased is $2,500,00, and. See publication 946, how to depreciate property. The first three years of macrs depreciation deductions Say your business bought $2,000 worth of office furniture and started using it may 1. Web section 179 allows for deductions up to $1 million per year for office furniture and equipment. Web based on the calculations, depreciation is $5,000 per year for 10 years. Web in order to calculate the depreciation of your piece of furniture, you need to take the total, not including sales tax, and divide it by its average life. Web according to the rules listed by the internal revenue service (irs), the furniture bought for commercial purposes start.

From www.coursehero.com

[Solved] Make journal entries. Wedona Energy Consultants prepares How Long To Depreciate Office Furniture Web real property is 39 year property, office furniture is 7 year property and autos and trucks are 5 year property. Web section 179 allows for deductions up to $1 million per year for office furniture and equipment. For example, office furniture belongs to the. Say your business bought $2,000 worth of office furniture and started using it may 1.. How Long To Depreciate Office Furniture.

From quickbooks.intuit.com

What is depreciation and how is it calculated? QuickBooks How Long To Depreciate Office Furniture See publication 946, how to depreciate property. Say your business bought $2,000 worth of office furniture and started using it may 1. For example, office furniture belongs to the. Web according to the rules listed by the internal revenue service (irs), the furniture bought for commercial purposes start. The first three years of macrs depreciation deductions Web based on the. How Long To Depreciate Office Furniture.

From www.youtube.com

Lesson 7 video 3 Straight Line Depreciation Method YouTube How Long To Depreciate Office Furniture Web based on the calculations, depreciation is $5,000 per year for 10 years. Web real property is 39 year property, office furniture is 7 year property and autos and trucks are 5 year property. Say your business bought $2,000 worth of office furniture and started using it may 1. Web according to the rules listed by the internal revenue service. How Long To Depreciate Office Furniture.

From www.chegg.com

Solved On March 31, 2024, Susquehanna Insurance purchased an How Long To Depreciate Office Furniture Web section 179 allows for deductions up to $1 million per year for office furniture and equipment. Web according to the rules listed by the internal revenue service (irs), the furniture bought for commercial purposes start. See publication 946, how to depreciate property. For example, office furniture belongs to the. The first three years of macrs depreciation deductions The total. How Long To Depreciate Office Furniture.

From exowmrhbn.blob.core.windows.net

How Long To Depreciate Flooring at Lottie Rogers blog How Long To Depreciate Office Furniture Web according to the rules listed by the internal revenue service (irs), the furniture bought for commercial purposes start. For example, office furniture belongs to the. The total allowance for equipment purchased is $2,500,00, and. Web real property is 39 year property, office furniture is 7 year property and autos and trucks are 5 year property. Web section 179 allows. How Long To Depreciate Office Furniture.

From exooapsto.blob.core.windows.net

How Much Does Furniture Depreciate at Martin blog How Long To Depreciate Office Furniture Web in order to calculate the depreciation of your piece of furniture, you need to take the total, not including sales tax, and divide it by its average life. For example, office furniture belongs to the. Web real property is 39 year property, office furniture is 7 year property and autos and trucks are 5 year property. Web according to. How Long To Depreciate Office Furniture.

From exowmrhbn.blob.core.windows.net

How Long To Depreciate Flooring at Lottie Rogers blog How Long To Depreciate Office Furniture The total allowance for equipment purchased is $2,500,00, and. Web according to the rules listed by the internal revenue service (irs), the furniture bought for commercial purposes start. See publication 946, how to depreciate property. Web in order to calculate the depreciation of your piece of furniture, you need to take the total, not including sales tax, and divide it. How Long To Depreciate Office Furniture.

From www.ispaceoffice.com

Does Office Furniture Depreciate? iSpace Office Interiors How Long To Depreciate Office Furniture The total allowance for equipment purchased is $2,500,00, and. Web here’s how it works under the normal rules: Web in order to calculate the depreciation of your piece of furniture, you need to take the total, not including sales tax, and divide it by its average life. The first three years of macrs depreciation deductions Web according to the rules. How Long To Depreciate Office Furniture.

From www.examples.com

Depreciation Schedule 6+ Examples, Format, How to Build, Pdf How Long To Depreciate Office Furniture Web according to the rules listed by the internal revenue service (irs), the furniture bought for commercial purposes start. The total allowance for equipment purchased is $2,500,00, and. Web section 179 allows for deductions up to $1 million per year for office furniture and equipment. Say your business bought $2,000 worth of office furniture and started using it may 1.. How Long To Depreciate Office Furniture.

From haipernews.com

How To Calculate Depreciation Cost Haiper How Long To Depreciate Office Furniture Say your business bought $2,000 worth of office furniture and started using it may 1. The first three years of macrs depreciation deductions Web based on the calculations, depreciation is $5,000 per year for 10 years. Web here’s how it works under the normal rules: The total allowance for equipment purchased is $2,500,00, and. See publication 946, how to depreciate. How Long To Depreciate Office Furniture.

From publicdomainvectors.org

Office workplace furniture Public domain vectors How Long To Depreciate Office Furniture Web in order to calculate the depreciation of your piece of furniture, you need to take the total, not including sales tax, and divide it by its average life. The total allowance for equipment purchased is $2,500,00, and. Web based on the calculations, depreciation is $5,000 per year for 10 years. Web here’s how it works under the normal rules:. How Long To Depreciate Office Furniture.

From www.chegg.com

Solved On March 31, 2024, Susquehanna Insurance purchased an How Long To Depreciate Office Furniture Web in order to calculate the depreciation of your piece of furniture, you need to take the total, not including sales tax, and divide it by its average life. Web real property is 39 year property, office furniture is 7 year property and autos and trucks are 5 year property. For example, office furniture belongs to the. Say your business. How Long To Depreciate Office Furniture.

From www.examples.com

Depreciation Schedule 6+ Examples, Format, How to Build, Pdf How Long To Depreciate Office Furniture Web real property is 39 year property, office furniture is 7 year property and autos and trucks are 5 year property. Web according to the rules listed by the internal revenue service (irs), the furniture bought for commercial purposes start. Web in order to calculate the depreciation of your piece of furniture, you need to take the total, not including. How Long To Depreciate Office Furniture.

From exowmrhbn.blob.core.windows.net

How Long To Depreciate Flooring at Lottie Rogers blog How Long To Depreciate Office Furniture See publication 946, how to depreciate property. Web section 179 allows for deductions up to $1 million per year for office furniture and equipment. Web here’s how it works under the normal rules: Web based on the calculations, depreciation is $5,000 per year for 10 years. The first three years of macrs depreciation deductions The total allowance for equipment purchased. How Long To Depreciate Office Furniture.

From haipernews.com

How To Calculate Depreciation Expense For Tax Purposes Haiper How Long To Depreciate Office Furniture Web according to the rules listed by the internal revenue service (irs), the furniture bought for commercial purposes start. Web real property is 39 year property, office furniture is 7 year property and autos and trucks are 5 year property. Web section 179 allows for deductions up to $1 million per year for office furniture and equipment. The first three. How Long To Depreciate Office Furniture.

From www.ispaceoffice.com

Does Office Furniture Depreciate? iSpace Office Interiors How Long To Depreciate Office Furniture Web in order to calculate the depreciation of your piece of furniture, you need to take the total, not including sales tax, and divide it by its average life. Web according to the rules listed by the internal revenue service (irs), the furniture bought for commercial purposes start. The total allowance for equipment purchased is $2,500,00, and. For example, office. How Long To Depreciate Office Furniture.

From exooapsto.blob.core.windows.net

How Much Does Furniture Depreciate at Martin blog How Long To Depreciate Office Furniture Web based on the calculations, depreciation is $5,000 per year for 10 years. Web here’s how it works under the normal rules: The total allowance for equipment purchased is $2,500,00, and. For example, office furniture belongs to the. Web in order to calculate the depreciation of your piece of furniture, you need to take the total, not including sales tax,. How Long To Depreciate Office Furniture.

From dlrxhojneco.blob.core.windows.net

How To Calculate The Value Of Used Furniture at Edith Loos blog How Long To Depreciate Office Furniture Web based on the calculations, depreciation is $5,000 per year for 10 years. Web section 179 allows for deductions up to $1 million per year for office furniture and equipment. Web according to the rules listed by the internal revenue service (irs), the furniture bought for commercial purposes start. Web real property is 39 year property, office furniture is 7. How Long To Depreciate Office Furniture.